Business

CBN commences new cash limit policy; low circulation of new notes

The Central Bank of Nigeria (CBN) cash withdrawal policy has officially commenced today,Monday,January 9th, across the country.

There was scarcity of the new naira notes in the wake of the senate’s plea to “considerably adjust the withdrawal limits” in response to public outcry on the policy.

The CBN’s director of banking supervision, Haruna Mustafa, had last year announced limits on over-the-counter cash withdrawals, Automated Teller Machine (ATM) withdrawals, and point of sale (PoS) withdrawals.

Mustafa, passed this message in a communique, where it was stated that over-the-counter cash withdrawals by individuals and corporate entities should not exceed ₦100,000 and ₦500,000, respectively, per week and noted that withdrawal above these limits would attract processing fees of 5% and 10%, respectively

The apex bank also declared that the maximum cash withdrawal per week via ATM should be ₦100,000 subject to a maximum of ₦420,000 cash withdrawal per day adding that only denominations of ₦200 and below should be loaded into the ATM.

According to the CBN director, the maximum cash withdrawal from PoS terminals should be ₦20,000 daily.

Mustafa encouraged customers to embrace the use of other alternative channels like internet banking, mobile banking apps, USSD, cards/POS, eNaira etc. to conduct their banking transactions.

He noted that anyone who does not adhere to the new policy will face severe sanctions.

The directive was followed by outcry from the public and business owners, and CBN was forced to eventually increase the withdrawal limit of individuals and corporate organisations to N500,000 and N5 million, respectively.

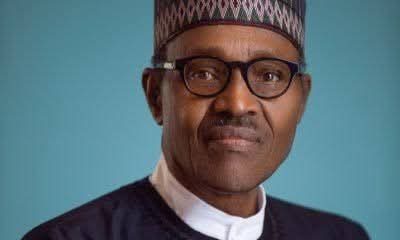

The directive was a result of the launch of the redesigned N200, N500 and N1,000 notes by President Muhammadu Buhari on Wednesday, November 23th, 2022.

CBN also insisted that Tuesday, January 31st remains the deadline for the usage of old notes in circulation despite worries about the shortages of new naira notes.

Meanwhile, an investigation showed that over-the-counter cash transactions within banking halls were still being done mostly with old notes, including withdrawals, instead of new notes, at a time the banks should be receiving old notes. Even the Automated Teller Machines (ATM) dispense old notes.

CBN said that there will be no extension for the use of the old notes beyond January 31, and advised Nigerians to ensure they deposited all the old N200, N500 and N1,000 banknotes in their possession before the deadline.

The CBN’s Deputy Governor in charge of financial system stability, Aisha Ahmad, told the House of Representatives during a public hearing on the implementation of the CBN cashless policy and the new withdrawal limits, that the CBN had ordered the printing of 500 million pieces of new naira notes in the first contract.